COVERAGE

AML Compliance Designed for Uzbekistan

Developed for Uzbekistan’s regulatory environment, our tools enable strong due diligence, accurate monitoring, and effective financial crime prevention across your organisation.

Trusted by 1,700+ clients globally

Who are the regulators in Uzbekistan?

Department for Combating Economic Crimes under the General Prosecutor’s Office of the Republic of Uzbekistan

Designated AML/CFT/CPF authority, receiving and analysing STRs and investigating financial crimes under the General Prosecutor’s Office.

Central Bank of the Republic of Uzbekistan (CBU)

Oversees implementation of the national AML/CFT/CPF system, supervises licensed financial institutions and conducts risk assessment, on‑site and off‑site monitoring of compliance with AML/CFT legislation.

The Inter-Agency Committee for Combating ML, CFT and the Financing of the Proliferation of Weapons of Mass Destruction

Established to manage national AML/CFT policy, inter‑agency cooperation and international engagement (EAG, FATF) in Uzbekistan.

Who is regulated in Uzbekistan?

Financial Institutions (FIs)

Who are classified as FIs?

Banks

Insurers

Payment Institutions

Investment Firms

Crypto/Digital Asset Service Providers

Designated Non-financial Businesses and Professions (DNFBPs)

Who are classified as DNFBPs?

Real Estate Agents

Dealers in Precious Metals or Precious stones.

Notaries

Accountants

Trust and Company Service Providers

Lawyers

Auditors

Dealers in any saleable item of a price equal to or greater than USD 15,000

Expectations for regulated firms

Apply a risk-based approach: conduct Customer Due Diligence (CDD), verify beneficial owners, and monitor transactions continuously.

Submit Suspicious Transaction Reports (STRs) to the Financial Monitoring Department (FIU) and maintain robust internal policies and controls

AML/KYC Checklist for Uzbekistan

- Verify identity of natural and legal persons.

- Identify and verify beneficial owners of corporate clients.

- Conduct risk profiling (PEPs, geography, product/channel).

- Apply Enhanced Due Diligence (EDD) for high-risk clients and retain records according to statutory retention requirements.

- Monitor transactions and report suspicious activity to the FIU.

Supervision & Enforcement

The Financial Monitoring Department (FIU) analyses STRs and coordinates with law enforcement for investigations.

The Central Bank of Uzbekistan (CBU) supervises financial institutions’ AML/CFT compliance, enforcing regulations and implementing risk-based oversight.

Other authorities (Ministry of Internal Affairs, State Customs, State Security) assist in AML enforcement, particularly for crypto and cross-sector activity.

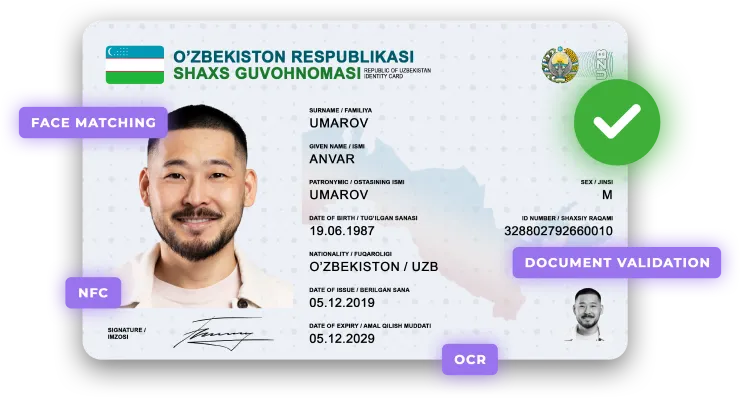

Supported ID documents from Uzbekistan

Public Services Card

Idenfo can verify the Uzbekistani National ID, issued by the Ministry of Justice, ensuring accurate data matching and full compliance with Uzbekistani regulatory requirements.

Document Verification

- Evaluates document quality by checking for glare or blur.

- Identifies any signs of tampering or forgery within the document.

- Confirms the authenticity of hologram prints.

- Extracts key data using optical character recognition (OCR).

NFC Scanning

- Reads data from the identity card's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

Irish Passport

Idenfo verifies Uzbekistani passports issued by the Ministry of Internal Affairs, confirming the holder’s name, date of birth, and contact details as part of Enhanced Due Diligence for KYC in Uzbekistan.

Document Verification

- Evaluates document quality by detecting glare or blur.

- Identifies potential tampering or forgery.

- Verifies the document’s format for accuracy.

- Cross-checks data against the MRZ code and hologram.

NFC Scanning

- Reads data from the passport's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

How it works

Document Capture

Scan and extract key identity details from official documents.

Liveness Check

Ensure the person is real and matches their verified ID photo.

Data Verification

Cross-check personal details against trusted government sources.

Risk Screening

Assess AML and sanctions risks before onboarding customers.

User Authentication

Simplify returning logins with secure biometric authentication.