COVERAGE

Ireland-Ready AML & KYC Solutions

Supporting Ireland’s regulatory requirements, we provide secure, reliable compliance tools that strengthen risk management and ensure uninterrupted operational integrity.

Trusted by 1,700+ clients globally

Who are the regulators in Ireland?

Central Bank of Ireland

The Central Bank of Ireland serves as the country’s primary financial regulator, overseeing banks, credit unions, insurers, and other financial institutions to ensure compliance and sector stability.

Criminal Assets Bureau (CAB)

CAB is a specialised law enforcement body focused on disrupting organised crime by identifying, seizing, and confiscating assets linked to unlawful activities, including money laundering.

Law Society of Ireland

The Law Society regulates solicitors in Ireland, setting professional standards and enforcing AML obligations for legal practitioners and law firms.

Institute of Chartered Accountants in Ireland (ICAI)

ICAI provides regulatory guidance and AML compliance standards for chartered accountants, ensuring its members uphold required professional and financial integrity measures.

Property Services Regulatory Authority (PSRA)

The PSRA supervises estate agents, auctioneers, and property management companies, ensuring the property services sector adheres to AML regulations.

Revenue Commissioners

Ireland’s Revenue Commissioners manage tax administration and enforcement, collaborating with other authorities to combat money laundering, tax evasion, and related financial crimes.

Who is regulated in Ireland?

Financial Institutions (FIs)

Who are classified as FIs?

Banks

Payment and e-Money Institutions

Asset Managers

Insurers

Credit Institutions

Designated Non-financial Businesses and Professions (DNFBPs)

Who are classified as DNFBPs?

Real Estate Agents

Dealers in Precious Metals or Precious stones.

Notaries

Accountants

Trust and Company Service Providers

Auditors

Casinos

Art Dealers

Auctions Houses

All Legal Professionals

Expectations for regulated firms

Firms must adopt a risk-based approach, applying Customer Due Diligence (CDD) including identifier verification, beneficial owner identification, transaction monitoring, and ensuring internal policies and controls

Enhanced Due Diligence (EDD) is required for higher-risk relationships and entities must maintain records and file Suspicious Transaction Reports (STRs).

AML/KYC Checklist for Ireland

- Verify the identity and legal status of clients (natural or legal persons).

- Identify and verify beneficial owners of legal entities.

- Carry out risk profiling (PEPs, sanctions exposure, geography, product/service risk).

- Apply EDD where required and capture source of funds/wealth when needed.

- Maintain evidence of CDD, screening and monitoring for the statutory retention period.

Supervision & Enforcement

The CBI uses a risk-based supervisory model: it conducts on-site inspections and off-site reviews, expects firms to demonstrate AML compliance, and can impose administrative sanctions (including fines, licence restrictions).

Supported ID documents from Ireland

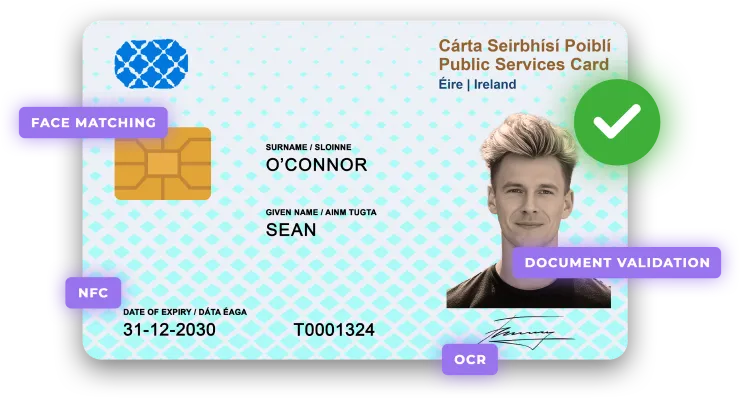

Public Services Card

Idenfo can verify the Irish Public Services Card, issued by the Department of Social Protection, ensuring accurate data matching and full compliance with Irish regulatory requirements.

Document Verification

- Evaluates document quality by checking for glare or blur.

- Identifies any signs of tampering or forgery within the document.

- Confirms the authenticity of hologram prints.

- Extracts key data using optical character recognition (OCR).

NFC Scanning

- Reads data from the identity card's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

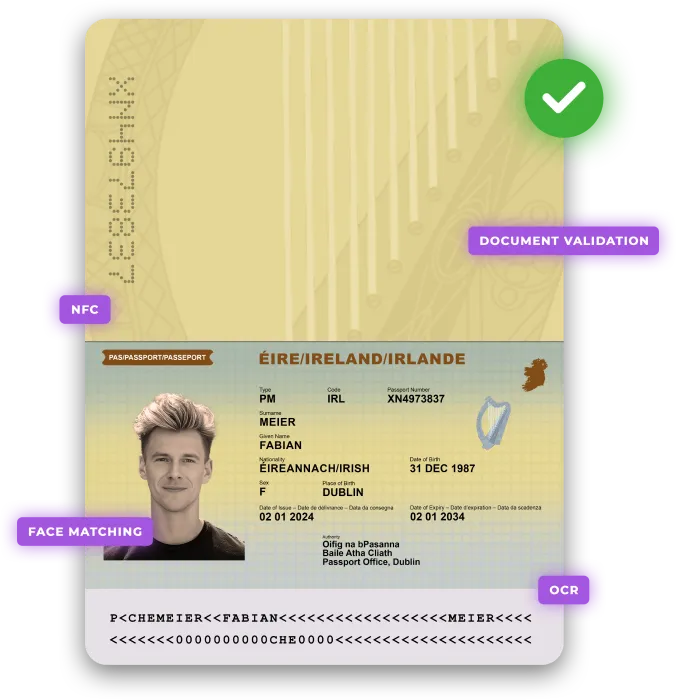

Irish Passport

Idenfo verifies Irish passports issued by the Department of Foreign Affairs, confirming the holder’s name, date of birth, and contact details as part of Enhanced Due Diligence for KYC in Ireland.

Document Verification

- Evaluates document quality by detecting glare or blur.

- Identifies potential tampering or forgery.

- Verifies the document’s format for accuracy.

- Cross-checks data against the MRZ code and hologram.

NFC Scanning

- Reads data from the passport's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

How it works

Document Capture

Scan and extract key identity details from official documents.

Liveness Check

Ensure the person is real and matches their verified ID photo.

Data Verification

Cross-check personal details against trusted government sources.

Risk Screening

Assess AML and sanctions risks before onboarding customers.

User Authentication

Simplify returning logins with secure biometric authentication.