COVERAGE

Strengthening Compliance in Pakistan

End-to-end AML/KYC tools built around Pakistan’s legal and supervisory requirements, helping firms stay compliant with confidence.

Trusted by 1,700+ clients globally

Who are the regulators in Pakistan?

National AML-CFT Authority

Coordinates and oversees the implementation of Pakistan’s national strategy to combat money laundering, terrorist financing and sanctions violations; acts as the central liaison with the FATF and other international bodies.

Financial Monitoring Unit (FMU)

Responsible for receiving and analysing Suspicious Transaction Reports (STRs) / Currency Transaction Reports (CTRs), and forwarding intelligence or freezing orders to relevant regulatory or law enforcement bodies.

State Bank of Pakistan (SBP)

Regulator for banks and development finance institutions; issues AML/CFT/CPF regulations for its regulated entities, supervises compliance and enforces penal or administrative actions.

Securities & Exchange Commission of Pakistan (SECP)

Supervises capital market intermediaries and regulates AML/CFT compliance within the securities and investment funds sector through its AML/CFT regulations.

Federal Board of Revenue (FBR)

Through its AML/CFT legislation portal and DNFBP guidance, it supervises non-financial businesses and professions, including real-estate agents, precious metals/stones dealers, and lawyers providing specified services.

Who is regulated in Pakistan?

Financial Institutions (FIs)

Who are classified as FIs?

Banks

Development Finance Institutions

Payment and e-Money Service Providers

Exchange Houses

Microfinance Institutions

Designated Non-financial Businesses and Professions (DNFBPs)

Who are classified as DNFBPs?

Real Estate Agents

Dealers in Precious Metals or Precious stones.

Notaries

Accountants

Trust and Company Service Providers

Lawyers

Auditors

Expectations for regulated firms

Firms must adopt a risk‑based approach, perform Customer Due Diligence (CDD) and beneficial‑owner verification, monitor transactions continuously, and file Suspicious Transaction Reports (STRs) with the FMU.

Enhanced Due Diligence (EDD) is required for higher‑risk relationships (including trade‑based money laundering risks), and firms must maintain internal governance, audit functions and compliance officers.

AML/KYC Checklist for Pakistan

- Verify identity of natural and legal persons, identify and verify beneficial owners.

- Conduct risk profiling (PEPs, sanctions exposure, geography, product/channel) and apply EDD where required.

- Collect source of funds/wealth information in higher‑risk scenarios, maintain documentation of CDD and retention of records per regulation.

- Ensure ongoing transaction monitoring and timely reporting of STRs to FMU

Supervision & Enforcement

The SBP supervises regulated entities (banks, DFIs, etc.) through updated AML/CFT/CPF regulations and can impose penal and administrative actions for non‑compliance.

The National AML/CFT Authority facilitates coordination across agencies, monitors implementation of risk assessments and high‑risk sectors, and aligns Pakistan with international standards.

Bureau Integrations:

Idenfo’s Integration with NADRA Bioverisys for Biometric Verification

The integration of Companies House with Idenfo brings instant access to verified UK company registration and director data. Together, businesses can streamline company onboarding, enhance KYB/AML compliance, and drastically reduce the risk of corporate fraud.

By automating validation against official UK records and eliminating manual checks, this integration enhances operational efficiency, elevates trust, and keeps your business aligned with today’s regulatory demands.

Industries & use cases

Instant Identity Validation

Connect directly to the national database for faster and more reliable onboarding.

Reduced Fraud Risk

Verify individuals against official records, reducing identity fraud and fake documents.

Compliance with Confidence

Fulfill compliance requirements with data sourced straight from regulatory authorities.

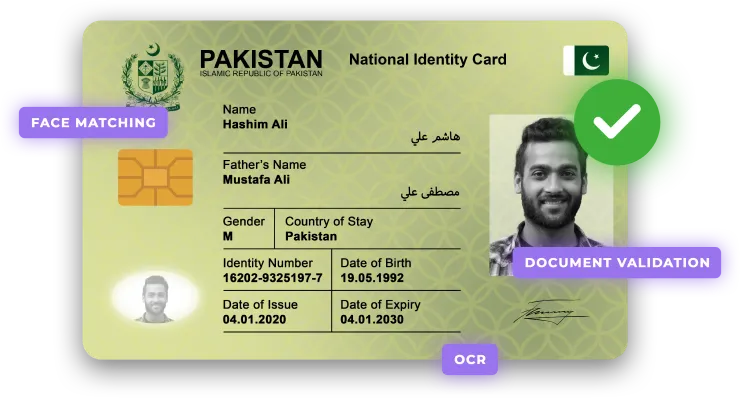

Supported ID documents from Pakistan

National ID

Idenfo can verify the Pakistani National ID (CNIC), issued by the National Database and Registration Authority (NADRA), ensuring accurate data matching and full compliance with Pakistani regulatory requirements.

Document Verification

- Evaluates document quality by checking for glare or blur.

- Identifies any signs of tampering or forgery within the document.

- Confirms the authenticity of hologram prints.

- Extracts key data using optical character recognition (OCR).

Pakistani Passport

Idenfo verifies Pakistani passports issued by the Directorate General of Immigration & Passports, confirming the holder’s name, date of birth, and contact details as part of Enhanced Due Diligence for KYC in Pakistan.

Document Verification

- Evaluates document quality by detecting glare or blur.

- Identifies potential tampering or forgery.

- Verifies the document’s format for accuracy.

- Cross-checks data against the MRZ code and hologram.

NFC Scanning

- Reads data from the passport's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

How it works

Document Capture

Scan and extract key identity details from official documents.

Liveness Check

Ensure the person is real and matches their verified ID photo.

Data Verification

Cross-check personal details against trusted government sources.

Risk Screening

Assess AML and sanctions risks before onboarding customers.

User Authentication

Simplify returning logins with secure biometric authentication.