COVERAGE

Your Compliance Solution for The United Kingdom

Purpose-built tools that align with UK regulatory frameworks, enabling accurate verification, easy onboarding and effective financial-crime prevention.

Trusted by 1,700+ clients globally

Who are the regulators in The UK?

Financial Conduct Authority (FCA)

The FCA supervises banks, investment firms, e-money institutions, payment firms, and crypto businesses for AML/CTF compliance under UK MLRs. It performs inspections, issues guidance, and enforces penalties.

HM Revenue & Customs (HMRC)

HMRC supervises money service businesses, trust and company service providers, high-value dealers, estate and letting agents, and art market participants for AML/CTF, registering, inspecting, and fining businesses.

Office for Professional Body Anti-Money Laundering Supervision (OPBAS)

OPBAS, within the FCA, oversees professional-body supervisors, ensuring consistent AML/CTF supervision and compliance with UK/EU standards.

Gambling Commission

The Gambling Commission supervises casinos and remote gambling operators for AML/CTF, ensuring KYC checks, transaction monitoring, and preventing criminal spend.

Office of Financial Sanctions Implementation (OFSI)

OFSI, part of HM Treasury, enforces the UK’s financial sanctions regime, works with AML/CTF supervisors to ensure compliance, imposes civil penalties, and issues mandatory guidance for regulated firms.

Who is regulated in The UK?

Financial Institutions (FIs)

Who are classified as FIs?

Banks

Payment and e-Money Institutions

Asset Managers

Insurers

Investment Firms

Virtual Asset Service Providers (VASPs)

Designated Non-financial Businesses and Professions (DNFBPs)

Who are classified as DNFBPs?

Real Estate Agents

Dealers in Precious Metals or Precious stones.

Notaries

Accountants

Trust and Company Service Providers

High Value Dealers

Lawyers

Casinos

Expectations for regulated firms

Firms must adopt a risk‑based approach, perform Customer Due Diligence (CDD), beneficial‑owner identification, ongoing monitoring, file Suspicious Activity Reports (SARs) with the National Crime Agency, and maintain robust internal controls.

Enhanced Due Diligence (EDD) is required for higher‑risk customers or jurisdictions, and firms are expected to demonstrate effective governance, senior‑management responsibility, and use technology where appropriate.

AML/KYC Checklist for The UK

- Verify identity of natural persons and legal entities; identify and verify beneficial owners.

- Undertake customer risk profiling (PEPs, sanctions exposure, geography, product/service risk).

- Apply EDD for high‑risk exposures and capture source‑of‑funds/wealth where required.

- Implement transaction monitoring, keep full CDD and screening records in line with retention rules.

Supervision & Enforcement

Supervisors such as the FCA and HMRC use on‑site inspections, desk reviews, and enforcement actions including fines, restrictions or revocations for non‑compliance. The 2023‑24 HM Treasury supervision report shows oversight of over 90,000 firms

Recent trends include heightened focus on crypto/VASP oversight, property sector transparency, and improved reporting quality.

Bureau Integrations:

Idenfo’s Integration with Companies House

The integration of NADRA Bio Verisys with Idenfo delivers a powerful leap in biometric identity verification for Pakistan. Together, they enable businesses to verify customers quickly, enhance compliance, and reduce the risk of fraud, all while providing a smooth, reliable user experience.

By simplifying verification processes and creating a secure, trusted environment, this integration boosts operational efficiency, increases customer confidence, and ensures businesses stay fully aligned with strict regulatory standards.

How does this integration benefit you

Instant Business Verification

Access UK company and director records in real‑time, speeding onboarding and due‑diligence.

Enhanced Compliance & KYB Accuracy

Pull data directly from the official register to strengthen KYB/AML checks and reduce manual errors.

Reduced Fraud Exposure

By validating against Companies House verified records, your business lowers risk of fake or misrepresented entities.

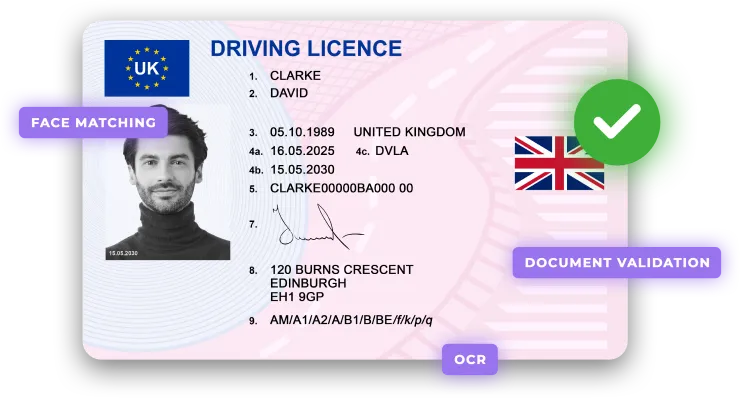

Supported ID documents from The UK

Driver’s Licence

Idenfo can verify the British Driving Licence, issued by the Driver and Vehicle Licensing Agency (DVLA), ensuring accurate data matching and full compliance with UK regulatory requirements.

Document Verification

- Evaluates document quality by checking for glare or blur.

- Identifies any signs of tampering or forgery within the document.

- Confirms the authenticity of hologram prints.

- Extracts key data using optical character recognition (OCR).

NFC Scanning

- Reads data from the identity card's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

British Passport

Idenfo verifies British passports issued by HM Passport Office, confirming the holder’s name, date of birth, and contact details as part of Enhanced Due Diligence for KYC in the UK.

Document Verification

- Evaluates document quality by detecting glare or blur.

- Identifies potential tampering or forgery.

- Verifies the document’s format for accuracy.

- Cross-checks data against the MRZ code and hologram.

NFC Scanning

- Reads data from the passport's NFC chip.

- Verifies the NFC chip data for integrity and authenticity.

How it works

Document Capture

Scan and extract key identity details from official documents.

Liveness Check

Ensure the person is real and matches their verified ID photo.

Data Verification

Cross-check personal details against trusted government sources.

Risk Screening

Assess AML and sanctions risks before onboarding customers.

User Authentication

Simplify returning logins with secure biometric authentication.